CAT: misc

Rankings

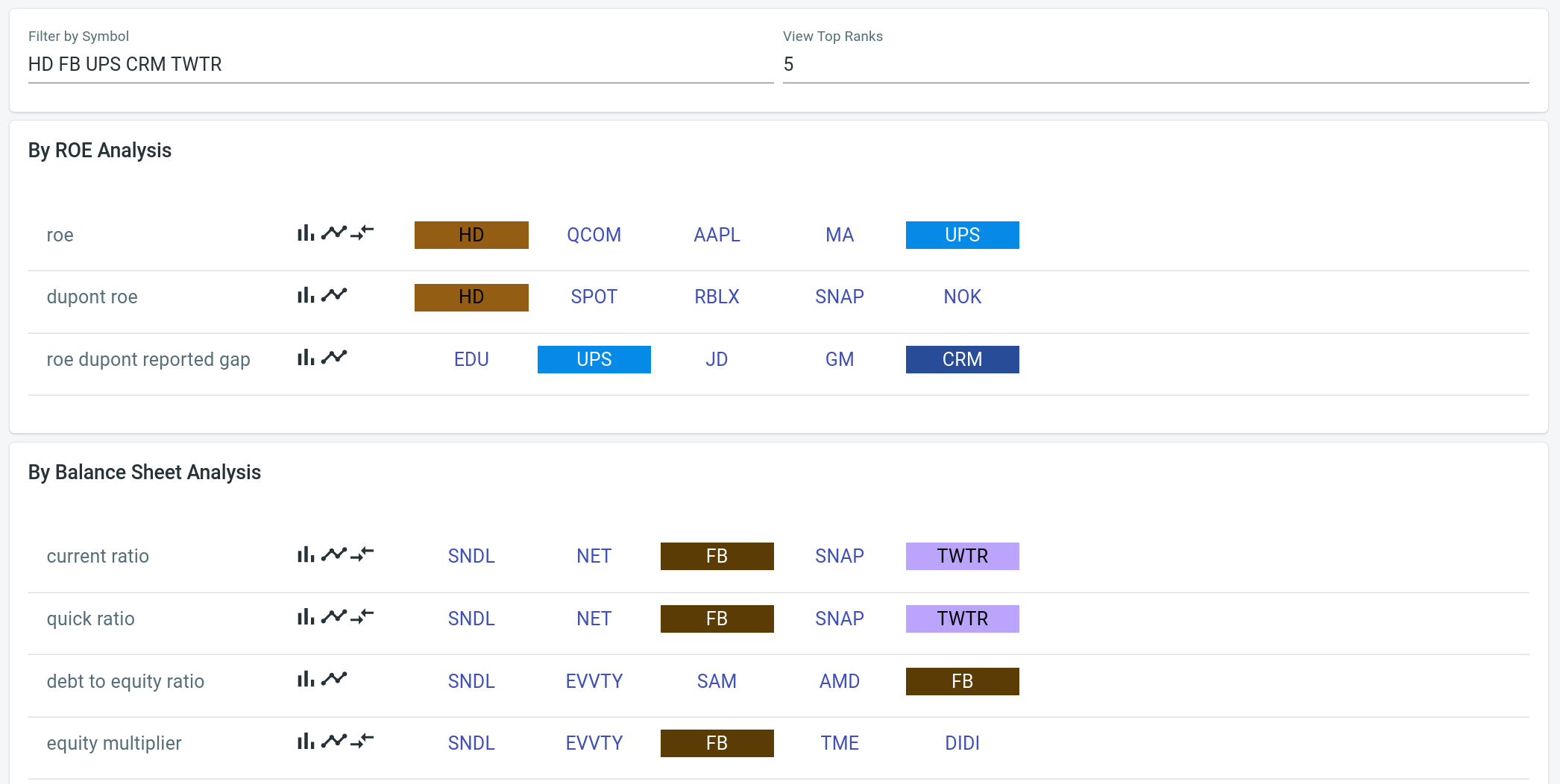

Now with each stock having an army of indexes computed from its price, statements and so on, one's ultimate goal is to use them to select the good stock. Instead of building a complex filter, we simplify the picking by ranking stocks along these indexes, and provide a rich feature using these rankings to help you verify your stock picking strategy.

Overview

There are five categories of data point we are providing:

- by ROE analysis: reported ROE, DuPont ROE

- by balance sheet analysis

- by income statement analysis

- by cash flow statement analysis

- by valuation ratios: P/E, P/B, P/S

Ranking could be from high-to-low or low-to-high depending on the

meaning of that particular index. For example, for current ratio,

higher is better, thus it is ranked from high to low, whereas for

debt growth rate, we view a growing debt negatively, thus it is

ranked low to high.

WARNING: Due to stocks having different reporting periods, there isn't an alignment to compare A's balance sheet on date XYZ w/ the …